Invoice Finance

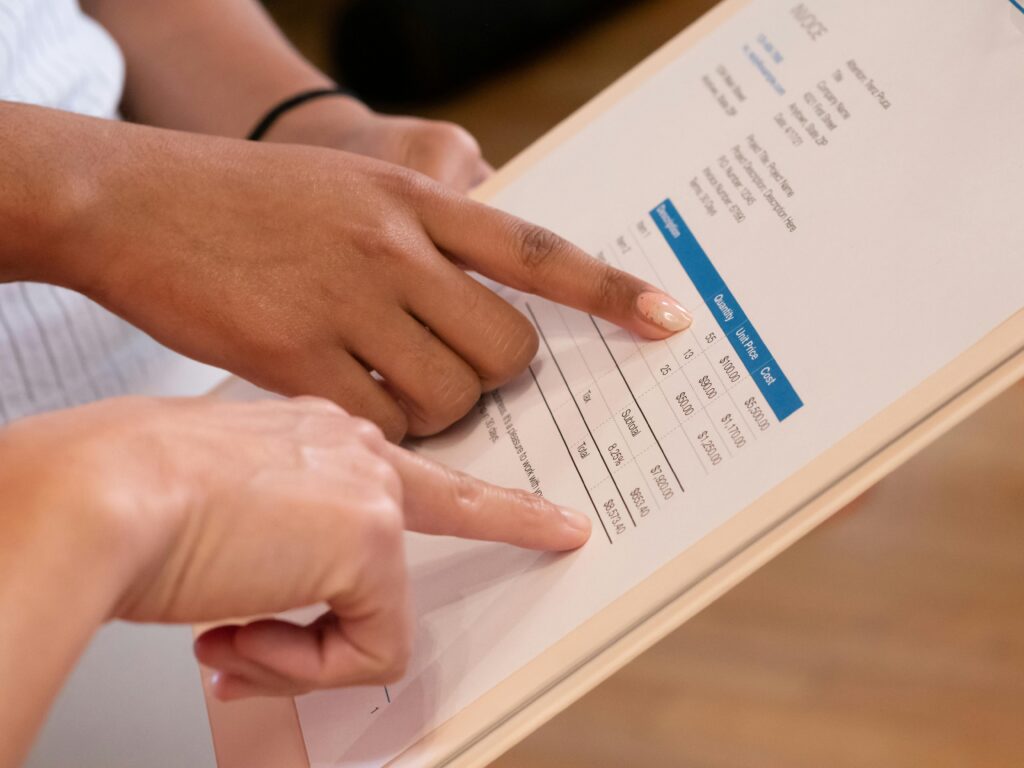

In the realm of finance, few tools are as powerful and flexible as Invoice Finance. It’s a strategic approach that allows businesses to leverage their accounts receivable to access immediate working capital. At RM Financial Solutions, we specialise in optimising this process for your benefit. Our Invoice Finance services are designed to alleviate the strains of waiting for customer payments, offering a lifeline of liquidity precisely when you need it most. With us, you can unlock the value of your outstanding invoices, fueling growth, and seizing new opportunities with confidence.

- Fast and Flexible Funding

- Streamlined Cash Flow Management

- Personalised Solutions

Art Direction.

Unlocking a plethora of opportunities

Why Invoice Finance ?

In the realm of business finance, efficient management of invoices is the cornerstone of sustainable growth. It’s not just about issuing invoices; it’s about optimising cash flow, reducing payment delays, and maintaining healthy customer relationships.

By streamlining the invoicing process, you can expedite the conversion of outstanding invoices into working capital, empowering your business to seize growth opportunities swiftly.

Effective Invoice Management minimises the risk of late or missed payments, providing a stable cash flow that fosters operational continuity and resilience, even in uncertain economic climates.

Adherence to regulatory requirements and industry standards reduces the risk of compliance penalties and financial discrepancies. Safeguarding against fraud and unauthorised.

Advantages of Invoice Finance

Invoice Finance stands out as a dynamic solution for businesses seeking to optimise their cash flow. At RM Financial Solutions, we’re committed to maximising the benefits of this innovative approach. With Invoice Finance, you gain immediate access to funds tied up in outstanding invoices, eliminating the wait for customer payments and providing a steady stream of working capital.

Empower Your Business with Smart Finance Solutions

Our Strategy

Our strategy at RM Financial Solutions revolves around a commitment to delivering tailored financial solutions that align with our clients’ unique needs and goals. We strive to be your trusted partner in navigating the complexities of finance.

- Client-Centric Approach

- Transparent Communication

- Continuous Innovation

- Strategic Partnerships

Book a Free Consultation

Ready to optimise your cash flow and propel your business forward? Contact us today to explore how our tailored financial solutions can drive your success. Let’s embark on this journey together towards financial stability and growth.

- Expert Guidance, Your Financial Compass

- Tailored Solutions, For Financial Advantage

Frequently asked questions.

Once approved, you submit your invoices to the finance provider who advances you a percentage of the invoice value, typically around 80-90%. When your customer pays, the remaining balance (minus a fee) is released to you.

nvoice Finance is flexible and can benefit businesses of various sizes, from startups to large corporations.

Generally with RM Finance, once set up, funds can be accessed within 24 to 48 hours of invoice submission.

Transparency is key at RM Financial Solutions. We are straightforward with all the fees associated wiht our services.

Yes, typically you have the flexibility to select which invoices to finance. This allows you to manage cash flow according to your business’s priorities and needs.